Affirm has proven to be a simple integration for most ecommerce platforms, but some stores report lower than expected acceptance rates due to customer credit scores. This has spawned a subprime (more sensitively described as “non-prime”) industry for BNPL.

This has left companies juggling multiple providers, a first tier provider such as Klarna, Affirm, Afterpay, or PayPal, and a slew of up and coming providers that may accept higher credit risk customers such as Katapult, Sezzle, or Quadpay.

One of the most overlooked values of any of these platforms is the advantage of advertising the BNPL price. It’s often said that the price is the most important piece of information about a product. It puts the product in context of other products in the market. We compare products based on price and calculate tradeoffs. When we see a BNPL price it triggers a new compare and consideration cycle.

We are psychologically wired to go through a new price to value rationalization process at the lower displayed price. As soon as we see the lower BNPL price we compare at that price. This makes the purchase much easier to rationalize.

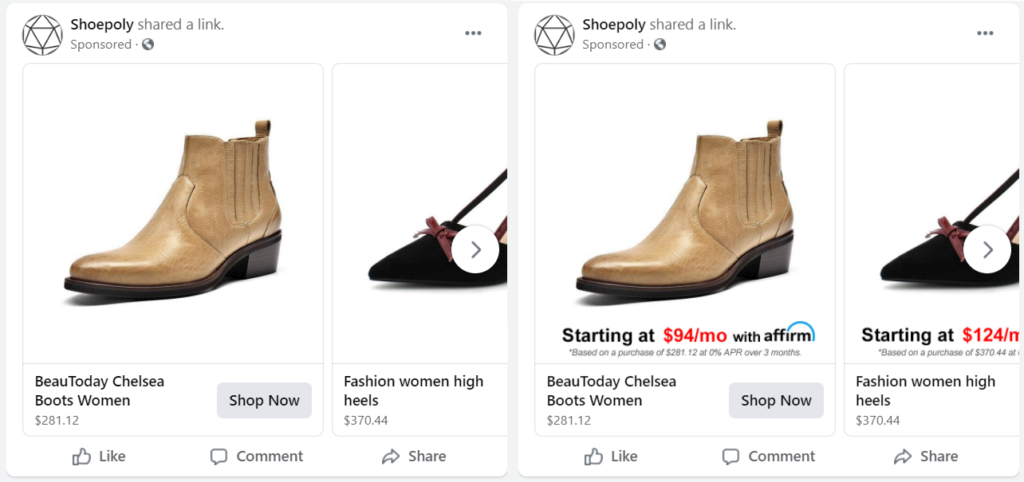

To get the most out of BNPL we need to advertise the BNPL price. On the left is a Facebook DPA with a $281.12 price and on the right is a DPA that features the 3 month BNPL price.

These prices can change how we perceive the product independently of how we pay for the product. We may still pay the full price, but use the installment price to help us rationalize the purchase. Example, if a treadmill is $1,200 and we see the BNPL price of $100/mo. we might end up comparing it to gym membership and rationalize that it’s not really that expensive over time.

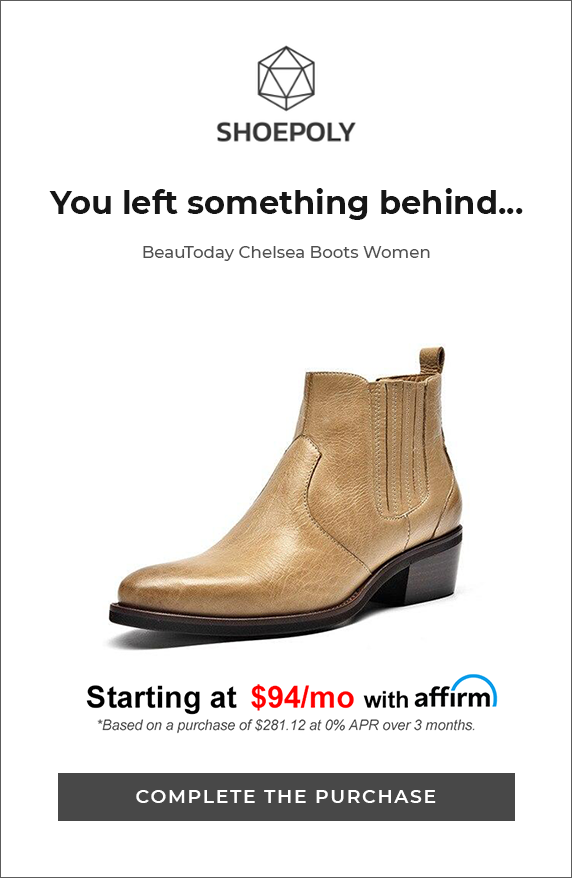

Abandoned cart emails are usually just reminders to keep a product top of mind. If you include the BNPL pricing it can change a reminder into a trigger, triggering a new cycle of consideration.

Banner retargeting can also be a trigger instead of a reminder. The lower price draws the eye and can change perceptions.

It’s not just price psychology, sometimes we are constrained by manufacturer retail price advertising limits. We can’t advertise below our competitors because of the MAP agreement. BNPL advertising can be a viable workaround. It’s not an actual lower retail price, but it can be perceived as one by the customer.

If you have a large catalog we recommend our Water Bucket transformation service. We can transform your entire ecommerce feed catalog’s image assets to feature the BNPL prices no matter what platform you use. This catalog will dynamically change as your prices change. This is an example image of what’s possible through dynamic transformation using the Affirm price.

To get the most out of Affirm, or any BNPL provider we should all take advantage of price psychology to drive more conversions regardless of the payment method. To learn more reach out to our team info@ironpulley.com